The tepid recovery from the Great Recession prompted many to conclude that low growth, or “secular stagnation,” would plague the U.S. economy indefinitely. However, the first three years of the Trump Administration prove that a prolonged period of low growth was far from inevitable. This increased growth has coincided with Administration policies like lower taxes, substantial deregulation, and pro-innovation energy policy.

Even with this remarkable turnaround, some falsely claim that President Trump simply inherited today’s historically-strong economy. As today’s release of the 2020 Economic Report of the President shows, the impressive economic gains under President Trump vastly exceed forecasts from before the 2016 election and results from the previous part of the expansion.

Typically, growth is faster at the start of an economic expansion, before tapering off as the recovery continues. Similarly, it is much more difficult to create jobs later in an expansion when the unemployment rate is already low. The current recovery differs from past ones because growth accelerated starting in 2017—more than seven years into the recovery.

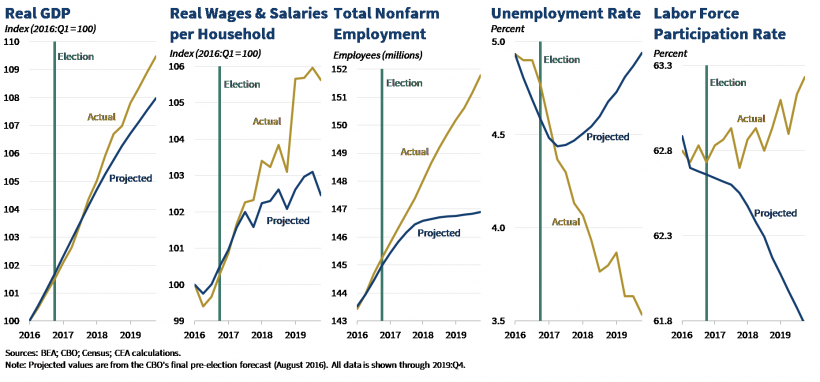

The Congressional Budget Office’s (CBO) final pre-election forecasts from August 2016 illustrate how today’s economic turnaround was unexpected before President Trump’s election. As of the end of 2019, the figure below illustrates five ways economic results under President Trump exceeded CBO’s forecasts:

- Real GDP is 1.4 percent—or $260 billion—higher than projected;

- Real wage and salary compensation per household is roughly $2,300 higher than projected;

- Total nonfarm payroll employment is 5 million higher than projected;

- The unemployment rate is 1.4 percentage points below projections;

- The labor force participation rate is 1.5 percentage points above projections.

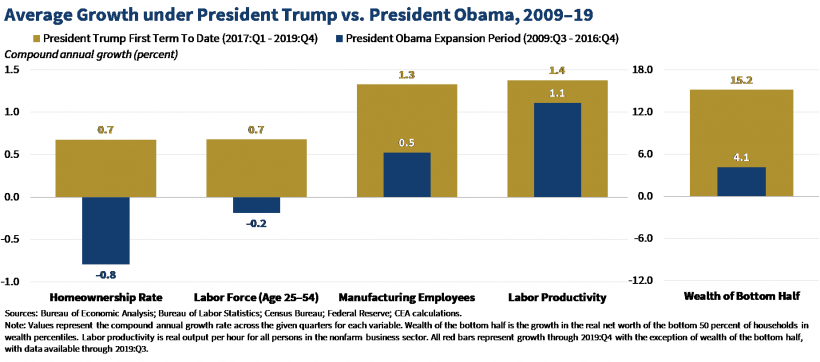

Beyond beating expectations, the economic results under President Trump also exceed the results from earlier in the expansion. Notably, there were turnarounds or improvements in the pre-election trends for homeownership, prime-age labor force participation, manufacturing employment, labor productivity, and net wealth for the bottom half of American households, as shown in the figure below.

The homeownership rate in the United States fell throughout most of the recovery but has rebounded under President Trump. As of the end of 2019, the U.S. homeownership rate reached 64.8 percent, which is 2.1 percentage points above the rate projected by the pre-election expansion period trend.

In the fourth quarter of 2019, a record-high 74.2 percent of new jobs were filled by workers coming off the sidelines. This influx of workers led the prime-age (25-54 years old) labor force participation rate to increased 0.7 percentage point at an annualized rate under President Trump, compared to a 0.2 percentage point annualized decrease over the Obama Administration’s expansion. Changes in labor force participation that appear small in magnitude have important effects on the job market. This change across administrations resulted in the prime-age labor force growing by 2.2 million under President Trump after shrinking by 1.5 million over the earlier part of the expansion.

Manufacturing production and employment stagnated over the last few years of President Obama’s second term. Despite both domestic and international headwinds, over President Trump’s first 37 months in office, the economy added half a million manufacturing jobs, nearly twice the amount added over the last 37 months of the prior administration (277,000). Additionally, over the first 37 months of the Trump Administration, manufacturing industrial production grew at an annual rate 11 times higher than the rate over the last 37 months of the Obama Administration.

Labor productivity growth in the nonfarm business sector, which is key for long-term growth, is up since President Trump took office, increasing 1.4 percent at an annual rate in the Administration’s first three years compared to a 1.1 percent annual rate under the prior administration’s entire expansion period. Further, labor productivity growth was slowing, falling to just a 0.9 percent annual pace during President Obama’s second term.

Since President Trump’s election, the working class has seen the largest share of income and wealth growth, lowering inequality. Beyond the bottom 10 percent seeing the highest wage growth under President Trump, net worth held by the bottom 50 percent of households has increased by 47 percent—more than three times the rate of increase for the top 1 percent of households. These recent gains are a sharp departure from the past. Under the Trump Administration, net worth for the bottom 50 percent of households has increased at an annual rate 15 times higher than the average growth seen under the three prior administrations’ expansion periods.

Because of recent growth, the American economy is stronger than other developed nations’ economies. From the beginning of the Trump Administration through the third quarter of 2019 (the latest comparable, available data), U.S. annualized GDP growth was more than a full percentage point above the other G7 countries’ average. The United States was one of only two G7 countries (the other being Japan, where projected growth was only 0.9 percent) that met the International Monetary Fund’s one-year-ahead growth projections for 2019. The other advanced countries saw large downward revisions. Furthermore, when compared to the earlier part of the recovery, the United States is the only major advanced economy with increasing productivity growth since 2017.

As the current record expansion matures beyond its tenth year, some worry that the expansion will “die of old age.” But academic evidence indicates that expansions do not end simply because of their length. Old age does not kill expansions, though bad policies can and do lead to recessions. The United States’ historically-strong labor market, buoyed by pro-growth policies, suggests that there is still substantial room to extend and further accelerate the longest expansion in U.S. history.